Before we talk about refinancing your home. Let’s talk about what refinancing is.

According to Investopedia,

A refinance occurs when a business or person revises a payment schedule for repaying debt. Mechanically, the old loan is paid off and replaced with a new loan offering different terms. When a company refinances, it typically extends the maturity date. Companies or individuals refinancing loans may have to pay a penalty or fee.

So what are the questions that you should ask before refinancing?

1. Is there a prepayment penalty on my current mortgage?

This should be asked to your lender. Many mortgages will charge you for a prepayment penalty. It can be several month’s worth but it still varies.

2. What are the cost of the new mortgage?

This really depend on the program that you’re qualified to have. Even if there are extra fees, you can still negotiate with the lender.

3. Will my tax savings be reduced?

This will be answered by your tax adviser. Have your tax adviser check if your overall savings will be increased if you refinance.

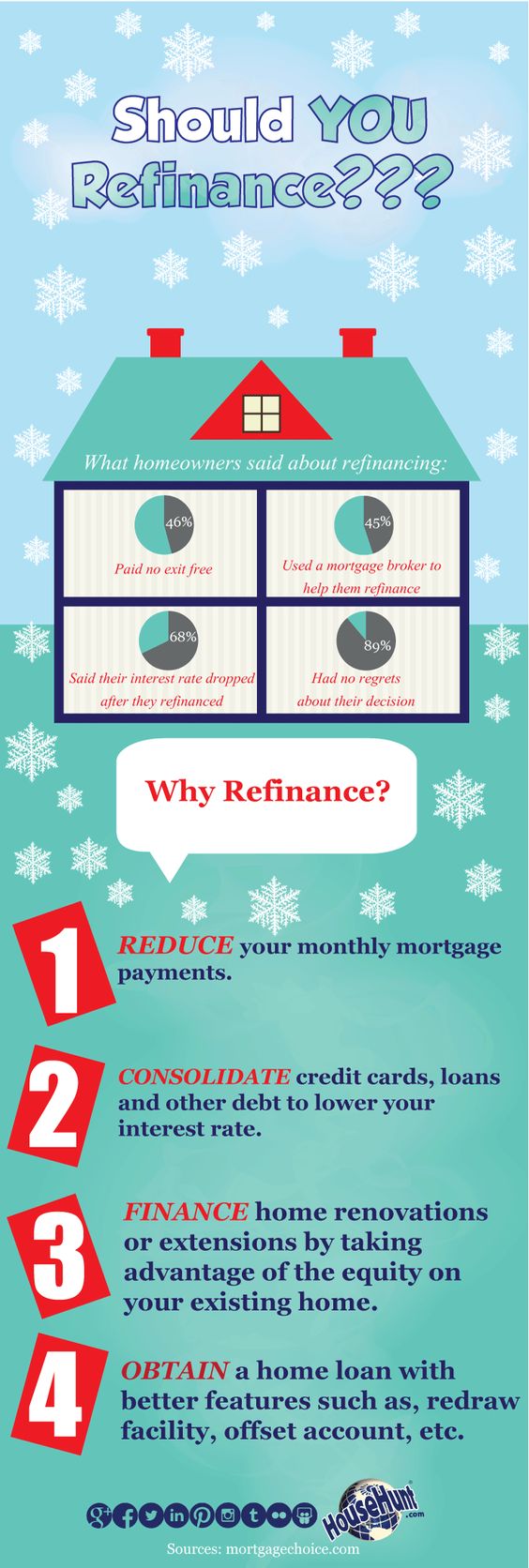

Checkout this Infographic and see the reasons why should you start considering to refinance.