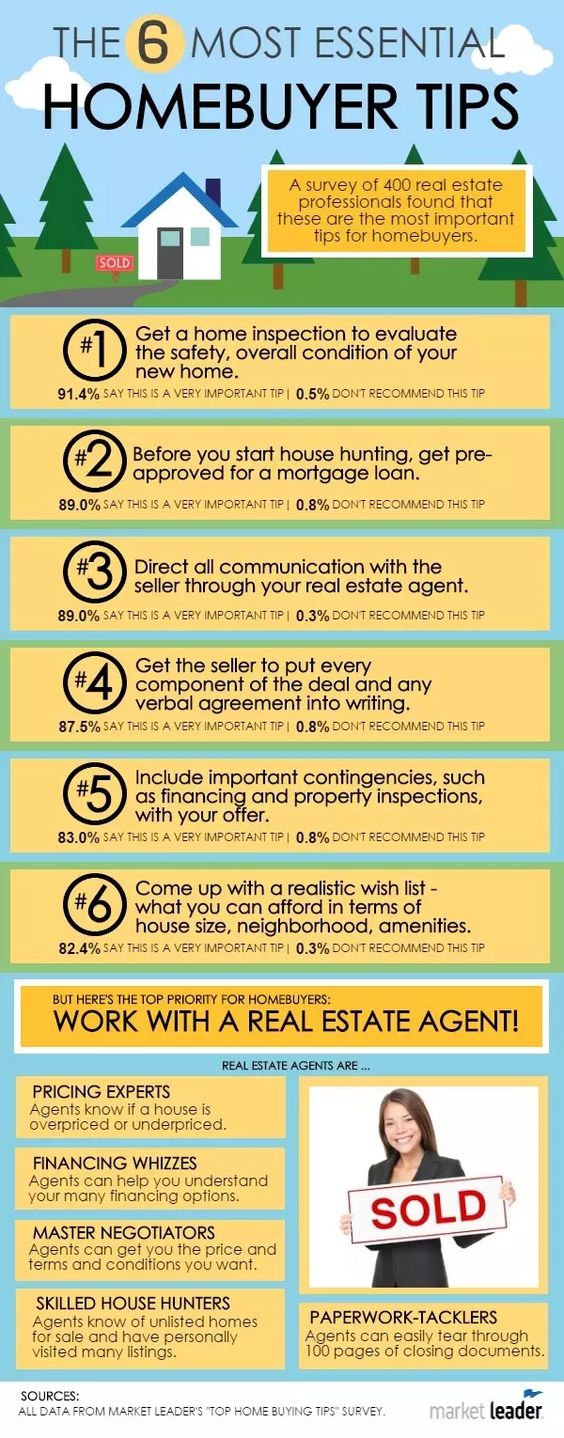

Whenever we search online for tips or best practices in the home-buying process, we’ll received thousands or millions of search results. And instead of helping us in removing our doubts towards the process and tasks, confusion takes place.

Fortunately, Market Leader gathered the tips from Real Estate Professionals and put it all on one list. They even took time to provide everyone an Infographic to help home-buyers understand the essentials in home-buying.

- Get a home inspection to evaluate the safety, overall condition of your new home. – This is a must in home-buying. As much as we want to move in as soon as possible, we don’t want our hard earned money to go to waste. It is very important to avoid a mistake by purchasing a property that’s in need of major repairs. Home inspection will keep you away from those costly repairs and danger.

- Before you start house hunting, get pre-approved for a mortgage loan. – Potential credit problems can be corrected since most of the Buyers are not aware of their credit. And if there are adjustments that needs attention, it will take months before it is corrected. It will also help Buyers to eliminate disappointments. It’s better to be aware if you’re credit can afford the house that you fell in love with.

- Direct all communication with the Seller through your Real Estate Agent. – Real Estate process can be tricky to Home-buyers. Why does all communication should always be through to your Real Estate Agent? It is because negotiating is a tricky business. There are also contracts that are very difficult to handle. And of course, Real Estate can’t lie.

- Get the Seller to put every component of the deal and any verbal agreement into writing. – Everything should be in black and white when it comes to any contracts and agreements.

- Include important contingencies, such as financing and property inspections, with your offer. – Same as number one, it is important to avoid any mistake in purchasing a property. It means your offer on a home has been made and the seller has accepted it, but the finalized sale is contingent upon certain criteria that have to be met. This will ensure that before the sale is finalized, all listed on your contingencies will be met.

- Come up with a realistic wishlist – what you can afford in terms of house size, neighborhood, amenities. – Number two on this list will come into action for this tip. As much as we want to have that dream house, it all boils down to our credit being approved or not. As soon as you already have the pre-approval letter, you will have a better understanding on what is within your budget.